Capital Gains Tax (CGT) in Cambodia 2025 - 2026

What expats and investors must know about the new CGT rules

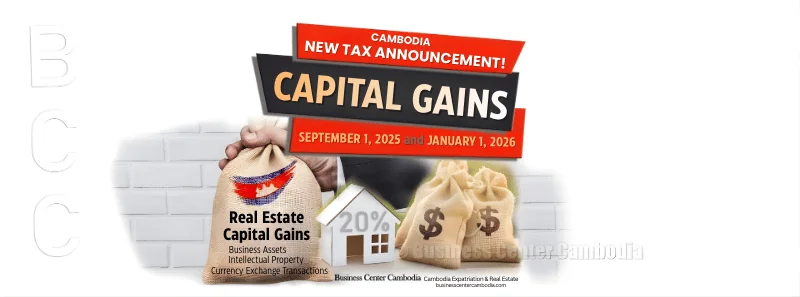

Cambodia Introduces a New Capital Gains Tax (CGT)

Cambodia is officially implementing a new tax on capital gains, known as Capital Gains Tax (CGT). The CGT applies to both residents and non-residents who sell or transfer specific categories of assets.

The tax rate is a flat 20%, with possible deductible options depending on the asset type. For real estate transactions, taxpayers may choose between:

- a simplified fixed-rate method, or

- a real-cost deduction method,

depending on their situation.

Progressive Implementation of Capital Gains Tax (CGT) in Cambodia

Starting 1 September 2025

The CGT will apply to gains generated from the following assets:

- Lease contracts

- Investment assets (shares, bonds, securities)

- Business goodwill

- Intellectual property

- Foreign exchange operations

This first phase expands taxation to non-traditional assets, reflecting Cambodia’s evolving economic environment.

Extension to Real Estate (From 1 January 2026)

From 1 January 2026, CGT will also apply to real estate transactions.

This delay is intentional to give:

- Taxpayers

- Property developers

- Regulatory bodies

time to adapt their valuation practices, accounting procedures, and required documentation especially for real estate sales, which represent a major part of Cambodia’s economy.

Who Is Taxable Under Cambodia’s CGT?

CGT applies differently depending on whether a person is a tax resident or non-resident.

Residents are taxed on worldwide capital gains, including:

- Sales or transfers of assets located in Cambodia

- Sales or transfers of assets located abroad

A person is considered a tax resident if they meet at least one of the following criteria:

- They have a residence in Cambodia

- Cambodia is their principal place of living

- They stay more than 182 days in Cambodia within a 12 month period

➡️ The 182 day rule is the most decisive criterion.

Non-residents are taxed only on capital gains sourced in Cambodia, including:

Sales of real estate located in Cambodia, even if the owner is a foreign national

- Transfers of shares in a Cambodian company

- Capital gains generated outside Cambodia are not taxable.

A taxpayer (individual or company) is considered non-resident if they:

- Do not have a residence in Cambodia

- Do not consider Cambodia their primary place of living

- Spend less than 182 days per year in Cambodia

For companies: if they are incorporated abroad, managed from abroad, or located outside Cambodia, they are classified as non-resident entities.

What Assets Are Subject to Cambodia’s Capital Gains Tax (CGT)?

Cambodia’s Capital Gains Tax (CGT) applies to profits generated from the sale or transfer of six major categories of assets. Depending on the asset type, different valuation rules and deductions may apply.

Under Cambodian tax regulations, only specific types of property fall under the real estate category for CGT purposes.

➡️ Full details are available on the BCC Members’ private platform.

This category refers to transferable rights or contractual value linked to employees, which may arise during business transactions.

Examples include the valuation of workforce-related contractual rights during mergers or restructurings.

Why is it taxable?

Because these employee-related rights carry an economic value that can generate a gain when transferred.

➡️ More examples and explanations are available on the BCC Members’ private platform.

This includes:

- Shares

- Bonds

- Financial securities

- Other investment instruments that can generate capital gains

Any profit made from selling or transferring these investment assets is subject to CGT.

➡️ Detailed rules and exceptions are available for BCC Members.

Business goodwill represents the intangible value of a company, paid in addition to identifiable assets, during an acquisition.

This may include reputation, brand value, customer base, or intellectual components integrated into the business.

➡️ More information on valuation and deductions is available in the Members’ area.

This category includes:

- Patents

- Copyrights

- Logos

- Trade images and commercial designs

IP assets hold economic value and can generate taxable gains when sold or transferred.

➡️ Full definitions and calculation examples are available for BCC Members.

CGT applies to gains generated from the sale or transfer of foreign currencies other than the Cambodian Riel (KHR).

- The KHR is not subject to CGT

- All foreign currency gains are taxable

➡️ Additional regulatory notes are provided on the Members’ platform.

What Is Not Subject to CGT in Cambodia

Some assets and situations are explicitly excluded from the Capital Gains Tax:

Vehicles

Profits from selling vehicles (cars, motorbikes, etc.) are not subject to CGT, as they fall under a different tax regime (transport tax).

Ships, Boats, and Aircraft

These categories are explicitly excluded from CGT obligations.

Unrealized Gains

CGT does not apply to:

- Unrealized or latent gains

- Fair-value accounting adjustments

- Revaluation of investment holdings

Unless an asset is actually sold or transferred, no CGT is due.

Are You Living in Cambodia for 2 Years or More?

Expatri’ Infos is the Members-Only Offer Made for You!

-

A Members-only website providing detailed information on major topics relevant to expatriates,

-

A Cambodia News Channel to stay informed in real time,

-

A responsive team to answer your questions and make your life in Cambodia easier,

-

A large distribution network, and

-

A UNIQUE VIP service platform no need to travel, we take care of everything for you!

Capital Gains Tax on Real Estate in Cambodia

Sellers of real estate or land in Cambodia must pay a 20% tax on the capital gain, payable to the General Department of Taxation.

Because of the pandemic, the implementation of this tax, originally scheduled for January 2021, was postponed.

➡️ It will officially come into effect on January 1, 2026.

When Must the Real Estate Capital Gains Tax Be Applied in Cambodia?

The capital gains tax applies to real estate in the following cases:

- Sale, transfer, or creation of an occupancy right,

- Transfer of ownership or occupancy right registered with Cambodian authorities,

- Court decision that orders the transfer of ownership or occupancy right of the property.

Who Is Subject to the Real Estate Capital Gains Tax in Cambodia?

-

Foreign real estate investors, individuals, and Cambodian companies who are not tax residents must pay this tax upon the resale of their property, provided a capital gain is made.

-

Even if you transfer a property you own to your own company, this is considered a transfer and is therefore taxable.

Who Is Not Subject to the Real Estate Capital Gains Tax in Cambodia?

-

An individual selling their primary residence, as long as they have owned and occupied it for at least 5 years.

-

A company that is a tax resident in Cambodia, since it is already subject to the general tax regime including corporate income tax.

How Much Is the Capital Gains Tax in Cambodia?

The capital gains tax in Cambodia is 20%.

How Is the 20% Capital Gains Tax Calculated?

There are two methods to calculate capital gains on real estate:

A. Tax on Profit (Actual Profit Method)

Real deduction based on actual expenses (see Example A below).

B. Tax on Real Profit (Standard Deduction Method)

Deduction based on 80% deductible expenses (see Example B below).

Example

Property in Cambodia purchased for $70,000 and sold for $100,000.

1. Calculating the Cost Basis

Actual verified expenses with proof (invoices, receipts…).

Example: $4,900 in eligible costs.

Cost basis calculation:

70,000 $ (purchase price) + 4,900 $ (verified expenses) = 74,900 $

2. Calculating the Profit

100,000 $ (selling price) - 74,900 $ (cost basis) = 25,100 $ profit

3. Calculating the Capital Gains Tax

25,100 $ × 20% = 5,020 $

Allowable deductions using this method

- Purchase price

- Improvement investments

- Selling expenses

- Property taxes paid during ownership

- Maintenance expenses

- Interest on loans directly linked to the property

Note:

This method is more advantageous when real costs are high, but it requires strong documentation.

Under this method, 80% of the sale price is considered non-taxable.

The 20% tax is therefore applied only to the remaining 20%.

Calculation:

100,000 $ (selling price) - 80% = 20,000 $ taxable base

Capital gains tax:

20,000 $ × 20% = 4,000 $

Characteristics of this method

80% standard deduction from the sale price

The remaining 20% is the taxable base

- Advantage: Simple, fewer documents required

- Disadvantage: May result in higher tax if actual costs are low

Important Notes

-

Property owners may choose the method that is most advantageous to them, and the GDT cannot challenge the method chosen.

-

However, the GDT may challenge:

The property valuation, or

The declared expenses under the “Tax on Profit” method if you do not have sufficient supporting documents.

Taxable Value & Payment Deadlines

The taxable value is defined as the sale price or transfer price. The tax administration may adjust the declared value to match market value if the declared amount is considered inaccurate or undervalued.

Market Value Adjustment

If the declared transfer price is not considered genuine or is below fair market value, the tax authority may reassess the price using:

➡️ Detailed information available in the BCC Members area.

Payment Deadline

➡️ Detailed information available in the BCC Members area

Deductions for Calculating Capital Gains in Cambodia

Acquisition Costs

➡️ Detailed information available in the BCC Members area.

Improvement Costs

➡️ Detailed information available in the BCC Members area.

Selling Expenses

➡️ Detailed information available in the BCC Members area.

Limited Deductions

For assets such as shares, bonds, business goodwill, intellectual property, and foreign currencies, deductions are strictly limited to actual costs incurred:

➡️ Detailed information available in the BCC Members area.

CGT Exemptions

Capital Gains Tax does not apply in the following cases (under specific conditions):

Eligibility:

The taxpayer must be a tax resident and actively engaged in agricultural activities.

Verification:

Requires an approval or confirmation letter from the local authority or the RMD confirming agricultural use of the land.

Exemption condition:

The property must have been occupied as the taxpayer’s principal residence for at least five years prior to the sale or transfer.

If multiple properties are owned by the taxpayer or their spouse, only one residence may qualify as the principal home.

Inheritance

Exemption applies to transfers of real estate inherited from close biological relatives (parents, children, siblings).

Gifts

First-time gifts of real estate within the same immediate family are exempt.

Capital gains made by diplomatic missions, government institutions, or entities acting under public interest mandates (infrastructure projects, humanitarian programs, etc.) are exempt from CGT.

Allocations of new shares issued to increase a company’s capital are not considered transfers and therefore not subject to CGT.

➡️ More details available in the BCC Members area.

BCC Insight

Some of the current mechanisms make it difficult to apply this new tax consistently and efficiently. Revisions are expected in the coming months.

➡️ Updates will be communicated directly on our Telegram channel.

Business Center Cambodia

Your Real Estate Agency in Cambodia

For Rent - For Sale - Apartments, Houses, Land, Commercial Spaces

Our real estate website “BCC IMMOBILIER CAMBODGE” offers a wide selection of residential and commercial properties. From property visits to contract signing, you are supported by a fully registered and legally recognized agency, ensuring:

- Secure contracts

- Proper due diligence

- A trusted advisor who knows the laws and the local market